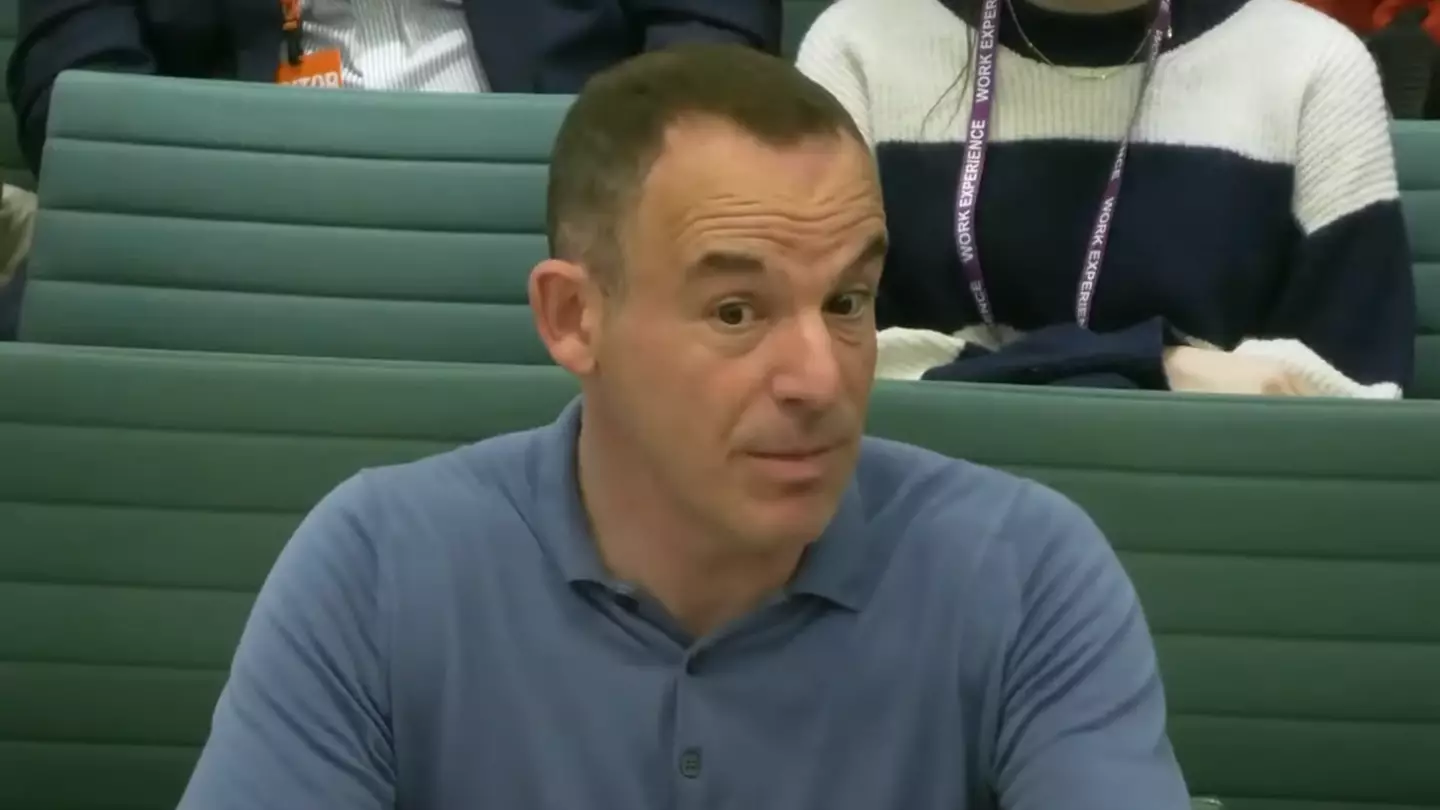

Martin Lewis issues major update to every Brit who bought a car on finance before 2021

Taking to social media, the financial journalist said there had been a ‘huge announcement’ by the Financial Conduct Authority when it came to the selling of car finance in the United Kingdom before 2021.

The FCA has for some time now been investigating the mis-selling of car finance between the years of 2007 and 2021, with hidden fees placed on agreements that consumers did not know about when signing off at the dealership.

Applicable to both personal contract purchase (PCP) or hire purchase (HP) deals, these fees – known as discretionary commission arrangements (DCAs) – applied to cars, vans, motorbikes, and even camper vans.

FCA car finance investigation latest

The FCA has given finance companies until 4 December, 2025 to respond to complaints, meaning there is still plenty of time to get your complaint in if you bought a car on PCP or HP during the qualifying period.

Previously, it had said that after May 2025, a decision will be made on how compensation may be given to consumers who have valid claims.

How much money could you get? Well, previous data from the FCA said that car buyers paid £1,100 more interest on a typical £10,000 four-year car finance deal. Take that as a good starting point to try and gauge what you could be owed.

The situation has now changed, though, as Lewis has pointed out.

Were you mis-sold? There’s a big possibility if you bought between 2007 and 2021 (Getty Stock Images)

You won’t need to complain directly

In a new explainer to the UK public, Lewis said explained how the FCA will now introduce an industry-wide ‘redress scheme’ if payments are confirmed (something Lewis is incredibly sure about).

Critically, it means that people aren’t going to have to put complaints in to get money.

“The regulator is going to tell lenders, ‘find everybody who was mis-sold under the criteria we give you, and then pay them out based on a formula that we’re going to give you’,” Lewis said in a video on TikTok.

“So it’s going to be masses more people… because it’s going to be proactive, rather than people having to complain.”

Don’t lose out on the full amount

As Lewis explains, some firms have said they will handle your complaint for you. And that’s for a fee, usually 25 percent of the final settlement figure you’re given.

Time to nip that in the bud, Lewis says, explaining: “It’s very likely, if a payout is going to come, you’re going to get that money automatically.”

More than two million complaints were lodged with car finance companies via Lewis’ free form he produced over on the Money Saving Expert website.

All in all, he reckons the final sum could be ‘tens of billions of pounds’ under a redress scheme similar to what was seen in the PPI scandal.