During ITV’s Martin Lewis Money Show Live on Tuesday (3 December), Martin explained what a credit score actually is and how to boost your chances of being accepted for a loan.

“You don’t have a credit score. You don’t have one,” he said.

“There is no single number that dictates if a lender will accept you.

“Each individual lender scores you differently based on it own wish list – not just about risk but what is profitable as a customer.

“The credit reference agencies market a credit scoring tool but it is just their idea, a rough example, of how a typical lender may look at you.

“It isn’t rock solid, it isn’t official.”

Essentially, Martin explained that a credit score is basically an estimation of how lenders view your financial profile.

Instead of stressing about slight changes in your credit score, it’s best to focus on measures that make you more favourable to lenders.

Martin explained credit scores on his Money Show (ITV)

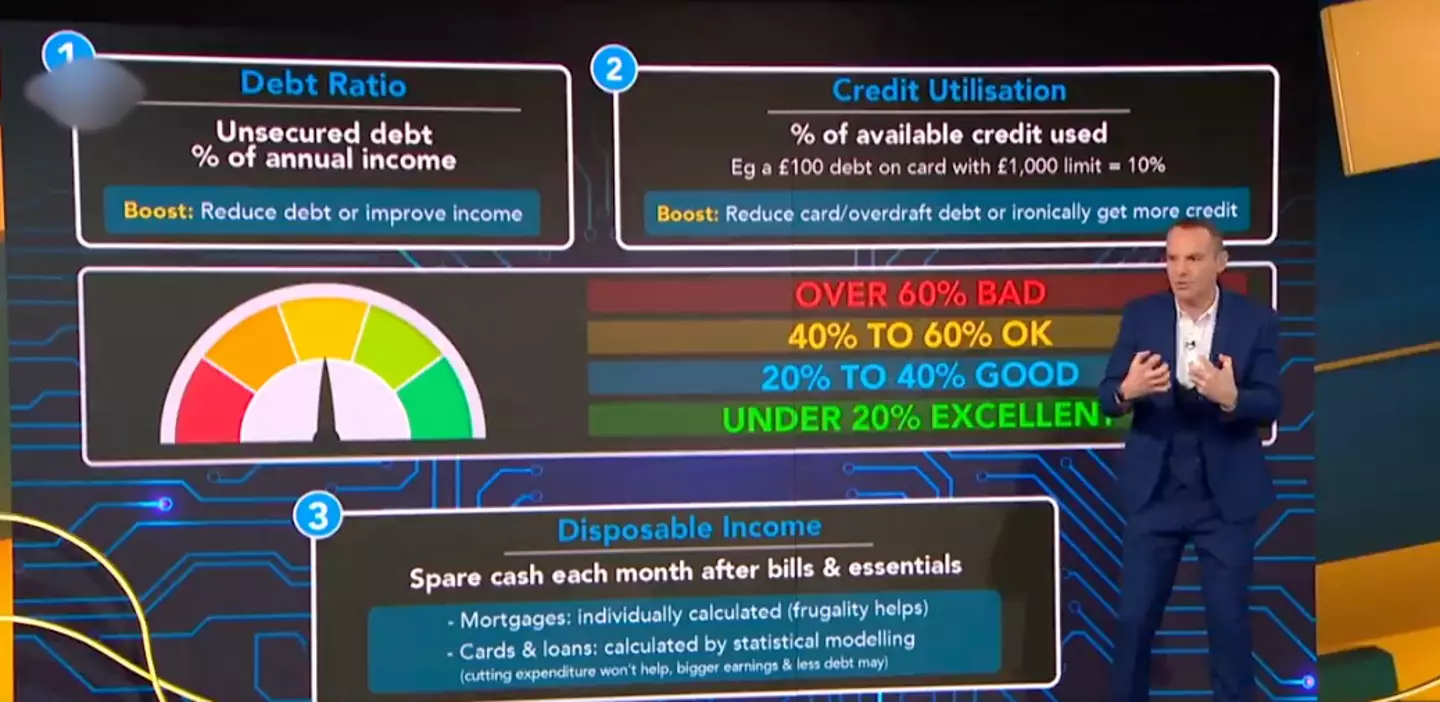

Use a debt ratio

Martin explained that lenders look at how much debt you have as a percentage of your annual income.

As an example, Martin explained: “Say you’ve only got a £10,000 credit card, you earn £40,000 – that is a 25 per cent debt ratio. Lower is better.”

To boost this, you’ll need to reduce debt or boost your income.

Credit utilisation

Lenders also look at credit utilisation, which is an assessment of how much credit you’re using.

For example, if you have a £1,000 credit limit and you’re £100 in debt, you have a 10 per cent credit utilisation.

This can be improved by using less of your overdraft or surprisingly, increasing your credit.

Martin said credit scores ‘aren’t real’ (Getty Stock Photo)

Disposable income

Martin explained that if you’re about to apply for a mortgage, for example, you should be ‘going frugal’ and trying to increase your disposable income – aka the money you have left once bills have been paid.

This is because lenders actually look at how much money you have left in your account via statements.

However, for credit cards and loans, lenders don’t have access to your statements, so they look at what a person in your circumstances would likely do, rather than assessing your accounts.

“The amount you earn and the amount of debt you have is factored in, so if you could earn more and reduce your debt, it could help on the disposable income,” said Martin.

Maintaining your credit file

Finally, Martin explained that making sure your credit file is up to date and correct is important.

For example, check for any mistakes or incorrect addresses as these can impact your file.

“I want you to go through these reports, line by line, even small errors can mean rejection,” Martin said.

“If you’ve got an old mobile phone contract that’s closed, but it’s linked to the wrong address, that could kibosh a mortgage deal.”

But do not fear; money expert Martin Lewis is here to advise you on how to ensure you’ll get accepted for a mortgage.

Speaking about mortgage rates and renters’ tips with Robert Gardner, the chief economist at Nationwide, Lewis explained that mortgage rates have finally started to fall – which sounds like a positive sign.

After answering questions about what first-time buyers should be, he explained how the mortgage process works.

Dave Benett/Getty

Martin explained that lenders always conduct credit checks when reviewing applications, so ensure that you have a high score.

But how can you do this?

Firstly, he says to check your credit report with the three credit agencies, Equifax, Experian, and Transunion, for potential pitfalls.

However, you must be careful while checking this line-by-line to ensure you don’t miss any avoidable mistakes.

Lewis said: “I know people who have not got a mortgage because of an old mobile phone that was linked to the wrong address,” adding that a case like that could be fraudulent.

I think we’ve all been there: forgetting to change our address for certain things, so that’s easy to miss!

Another key factor is making sure not to complete all payments and pay off your cards every month to show that you can pay large amounts off regularly and on time.

Getty Stock Photos

Martin also recommends that first-time buyers conduct an ‘affordability stress test’, which involves adding a rate to see if you could afford a more expensive mortgage than the one you’re currently eyeing.

Another important thing is to be more vigilant with your spending in the lead-up to the application because you will need to supply evidence of income, bills and spending habits.

So, it might be best to hold off on Uber Eats and Deliveroo for a bit. I know it’s tough, but we’ll all have to do it one day.

And finally, he recommends hiring a mortgage broker if you can, especially if you are ‘self-employed, live above a shop or have cladding’.

However, he suggests holding off payment to the broker until the deal has come through.

It’s a lot, but why not if it can get you closer to your first home?